Industrial Market Demand and Activity Remains Robust

Kansas City Industrial Overview

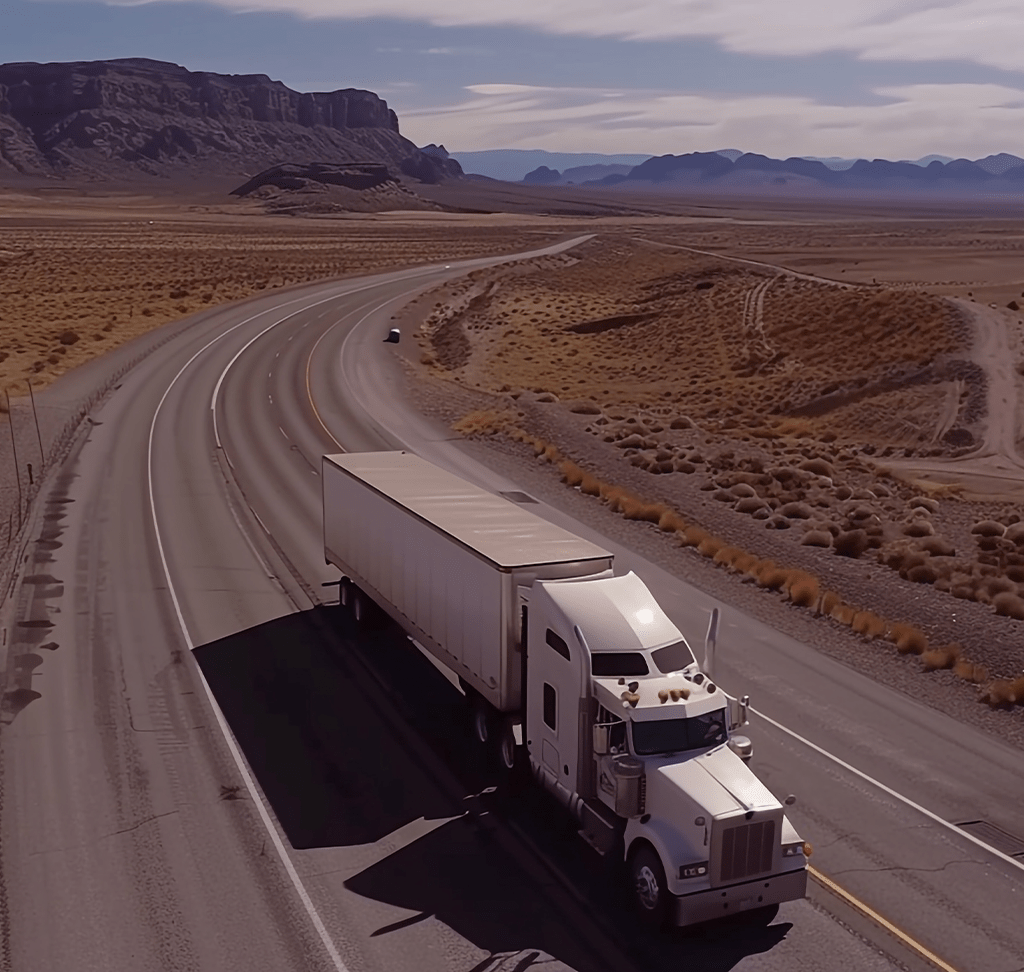

The industrial sector continues to recover and perform better than any other commercial real estate sectors throughout the Kansas City metro. Locally and nationally, industrial continued to post positive gains in Q3 2020, with the overall vacancy rate in Kansas City increasing slightly to 6.1% by the end of the quarter. The vacancy rate has declined by 10 basis points relative to this time one year ago. Net absorption totaled 1,751,177 SF for Q3 2020, slightly below the total quarterly delivery just over 2 million SF. Asking rents continue trending on a slight uptick, however, remaining relatively unchanged across the metro. Construction development, both speculative and build-to-suit, is approaching near all-time highs with several projects completed in Q3. Many additional projects are expected to be delivered by the end of the year, which will continue to drive elevated absorption totals throughout Q4 and into 2021. Currently, there is approximately 5.61 million SF within the development pipeline to be delivered in 2021.

Growth Within the Industrial Market

As a direct result of the COVID-19 pandemic, growth related to e-commerce sales has accelerated throughout the United States. Through the midway point this year, e-commerce activity accounted for a record of 11.8% of total retail sales, after steadily trending upward by about 1% annually for the past few years. By Q3, e-commerce sales accounted for 16.1% of all retail sales, a major increase in recent e-commerce related activity. Online grocery sales have contributed to this boom according to a recent study by grocery e-commerce specialist, Mercatus, projecting online grocery to expand to 21.5% of total U.S. grocery sales by 2025.

Industrial real estate throughout the United States will continue to outpace other sectors, as demand will continue to be fueled by consumers spending more online, propelling the explosion of e-commerce retail. Big-box omnichannel retailers, third-party logistics providers, and food and beverage manufacturers supporting both e-commerce and fulfillment will continue their expansion efforts across North America. Amazon continues to seek space in nearly every major market to fulfill their current demand levels. The increasing reliance on e-commerce for basic goods fueled demand for industrial bulk space as supply chains continue to be right-sized, shifting away from the former “lean” inventory strategies. Looking forward, we expect holiday sales to provide an additional boost to the industrial market in the fourth quarter.

From a manufacturing standpoint, the Institute for Supply Chain Management’s PMI index registered 55.4% in September. This figure indicates expansion in the overall economy for the fifth straight month after April’s initial contraction, with higher projections for the index in the future.

Recent Activity Around the Metro

The Kansas City industrial market continues to remain very active, spurred by the demand for distribution and warehouse space to keep pace with the growing e-commerce segment. Two large industrial users announced plans for Wyandotte County during Q3. Urban Outfitters will build a new 880,000 SF distribution facility near the Kansas Speedway. The planned $350 million development will support nearly 2,000 jobs upon completion in early 2022. Amazon announced they will occupy a new fulfillment center at the former site of The Woodlands racetrack, which is expected to create 500 new jobs. Scannell Properties will develop the logistics building with a footprint of just over 1 million SF with plans to develop additional buildings at the site in the future. KCI Logistics Centre announced two new tenants; Pure Fishing will occupy 542,000 SF, while Mechanix Wear will occupy 160,000 SF. In Liberty, Kenco Logistics, a leading 3PL, will occupy 295,000 SF in the first building of Liberty Logistics Park. Johnson County added two large tenants; American News Group leased 455,000 SF within Lone Elm 716, while Bayer/DHL leased 300,000 SF at Midwest Gateway Building 1. In Raymore, BoxyCharm leased 575,000 SF at Southview Commerce Building II.

Northland Park Buildings 5 and 6, totaling 900,000 SF, were delivered in Q3. Inland Port VII, a 953,000 SF spec building located at LPKC, also delivered in the third quarter. More than 5.69 million SF is under construction in the submarkets we are currently tracking, with an additional 2.05 million SF under construction in Cass County between Southview Commerce Center and Raymore Commerce Center. Additional deliveries expected to be complete by the end of 2020 include Liberty Logistics, Southview Commerce Building II, KCI Logistics VI, Northland Park Building 8, and the first Meritex surface building.

.ashx?sc_lang=en&bid=2c3f8386cf504a8d8ca5b714081ece58)