Feature

Healthcare Research Report: The Growth of Ambulatory Surgery Centers

Healthcare Services Report | Q3 2025

What sets us apart is not what we do, but how we do it.

Finance Solutions

Colliers Mortgage delivers access to a comprehensive platform of financing, funding, and capital solutions across all commercial property types. Invaluable insight and expert knowledge guide our clients through the mortgage and investment banking process, connecting them with the best financing option to accelerate their success.

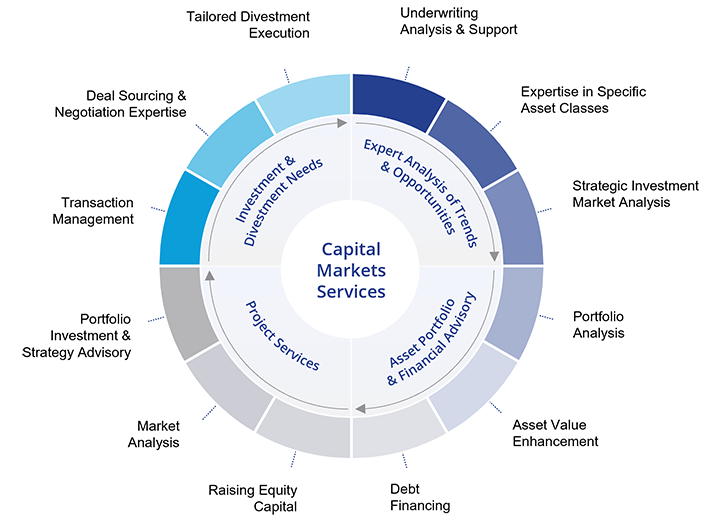

Industry Leading Access to the Capital Markets

We connect capital with opportunity by offering a full suite of services —from acquisition, refinance

and debt and equity solutions.

|

|

|

Our Affiliate Investment Firms Provide Additional Services

Colliers Mortgage works in tandem with affiliate companies to help produce debt and equity

solutions to meet our clients' needs.

|

Leader in demographic-driven alternative assets in senior living, student housing, medical office, life sciences, storage and digital assets. | |

|

Leader in equity and debt investments across multifamily, office, mixed-use, hospitality and retail. | |

|

Leading transatlantic infrastructure investment management firm specializing in mid-market, infrastructure equity investments across the utility, transportation, energy/renewable and communications sectors. |

|

|

Leading alternative real asset management firm offering investment solutions through actively managed, perpetual-life funds. |

The Colliers Mortgage Bank Participation Program is unique in that we structure competitive financing packages for borrowers and lenders alike. For developers, we create comprehensive, flexible debt facilities that often incorporate a variety of capital sources and financing alternatives. For lending institutions, we provide a thorough underwriting package that allows banks to analyze and independently assess each asset opportunity. Finally, we provide a full-service, back-office operations team that manages the various stages of the project’s lifecycle – from closing, funding and title to construction draw management, insurance coverage, reserve accounts, payment administration and pay off.

Our Service team works directly with borrowers and participant lenders to ensure all of the transaction’s latest information, communications and documentation are provided on a timely basis.

Lender: Century Housing

65% LTV Horizontal Development Loan for 250+ Affordable Multifamily Units at 7.75%

Los Angeles, CA

The Structured Finance Group recently closed a horizontal development loan for an infill land site in Los Angeles, CA. The loan is priced at 7.75% for 2 years with a 12-month extension and features open prepayment. The project is designated 100% affordable and slated for over 250 multifamily units. Construction will break ground in the next 24 months. The loan allows the Sponsor to repay an existing land loan, provides additional term to optimally time the commencement of construction, and has open prepayment providing even more flexibility to execute the business plan.

Our Sponsor is leveraging Los Angeles’ Executive Directive 1(ED1) initiative, which significantly expedites the permit approval process for projects meeting the 100% affordable criteria. In addition to ED1, our Sponsor is taking advantage of California’s State Density Bonus Law, which allows for an increase of the project’s maximum height, density, and FAR, as well as a reduction in the number of required parking spaces.

ED1 and the State Density Bonus Law are explicitly designed to significantly expedite the development of more affordable housing to Los Angeles. The Lender we secured for this project shares the commitment to building affordable housing in our community.

The Structured Finance Group looks forward to continuing to work with our Sponsor to bring more affordable housing to our community and will source the financing for the construction take-out loan for this and subsequent ED1 projects.

Reach out to our team if you would like to hear more about ED1, the various state density bonuses, and financing options.

Our loan servicing team is there immediately after closing, and for the duration of your loan, as part of our commitment to being a long-term partner. We look to differentiate ourselves from the pack with extra attention to detail, direct communication points and a desire to stand out in a crowded commercial and multifamily loan servicing industry.

Our $11 billion servicing portfolio includes properties in 46 states including Hawaii and Alaska while our capital base includes Fannie Mae, FHA, USDA, CMBS, banks and over 30 life companies. Our growing team of servicing professionals average nearly 15 years of experience in the industry across all property types and capital sources allowing you to feel comfortable that you’re in good hands during your entire loan term. It’s what sets us apart.

Client Login

If you're interested in Colliers Mortgage, fill out the form below and we will get back to you right away.