Office demand in San Diego faces significant decline amid COVID pandemic

Behind the Numbers

- For the first three quarters of 2020, the San Diego office market has amassed more than 1 million SF of negative absorption, driving up vacancy to around 12% countywide.

- After 30 quarters of continuously upward trending rental rate increases, the countywide average asking rental rate decreased by $0.01 to $2.92/SF/month. The Class A average asking rate also dipped by $0.01 to stand at $3.45/SF/month.

- Countywide overall vacancy increased to 11.8% in Q3 – from 11.0% in Q2 – posting the highest rate in more than three years.

Net Absorption

Overall office demand has been trending downward countywide since the first quarter of this year. In Q3, 429,281 SF of negative net absorption was recorded bringing year-to-date net absorption to a negative 1.04 million SF. A prevailing recession fueled by the COVID-19 pandemic has been especially challenging to the office market. Many businesses continue to implement work-from-home policies that have resulted in a significant drop in the amount of space being utilized during a typical workday. Additionally, some tenants have experience permanent layoffs, giving back unneeded space as they negotiate their lease renewals.

To put it into perspective, the large drop in demand in 2020 is the largest annual decrease recorded in the 25 years Colliers has tracked the office market. Only two years recorded negative net absorption, and both occurred during recessions. In 2001, demand fell by 10,718 SF – generally considered a statistically ‘flat’ year for demand. In 2008 during the height of great recession, the net decrease in demand totaled 695,416 SF. By year-end, 2020’s negative net absorption could nearly double that of 2008.

The decrease in demand affected all office classes countywide and vast majority of submarkets. In Q3, Carmel Valley posted the most positive net absorption (+252,059 SF) but was bolstered by several large tenants occupying the newly completed One Paseo office project. These tenants included ACADIA Pharmaceuticals (67,706 SF), JPMorgan Chase (33,315 SF), Fish & Richardson (32,300 SF), Deloitte (31,441 SF), Compass (22,624 SF) and Bank of America (20,301 SF).

The only other submarket where large blocks of net absorption greater than 20,000 SF occurred was Sorrento Mesa. BPS Bioscience occupied 28,431 SF at 6450 Mira Mesa Blvd and Eton Bioscience occupied the 21,278 SF building they purchased at 10179 Huennekens St. Notwithstanding these major move-ins, the submarket still reported negative net absorption of 3,470 SF. This was not due to several buildings with large blocks of move-outs, but rather a large base of buildings with relatively small amounts of negative net absorption.

In fact, only seven buildings countywide reported more than 20,000 SF of negative net absorption. Two of the largest move-outs included 33,500 SF of sublease space left by Houzz at DiamondView Tower in Downtown San Diego and Apple subsidiary Emotient’s vacating of 24,826 SF in UTC at 4435 Eastgate Mall. 92% of the buildings posting negative net absorption reported less than 10,000 SF. What this indicates is that smaller and mid-size move-outs are affecting a larger base of office buildings more so than in prior quarters when a few big vacancies in a smaller amount of buildings would drive individual submarkets into negative absorption territory.

Vacancy

Negative absorption in most submarkets throughout the County has caused the vacancy rate to increase to 11.8% at the end of Q3 – an 80-basis point (BPS) increase from the prior quarter. Direct vacancy increased to 10.8% (+59 BPS) and sublease vacancy increased to 1.0% (+21 BPS).

While sublease vacancy of 1% of the total office inventory might seem relatively low, it is important to note that it has been below that level for more than a decade. In fact, the prior twelve quarters have had an average sublease vacancy rate of 0.6%. Sublease vacancy reached a 15-year of 2.5% in Q4 2007 but dropped steadily and leveled out at 0.7% up until early 2020. Direct vacancy remains lower than the 15-year average of 12.2%.

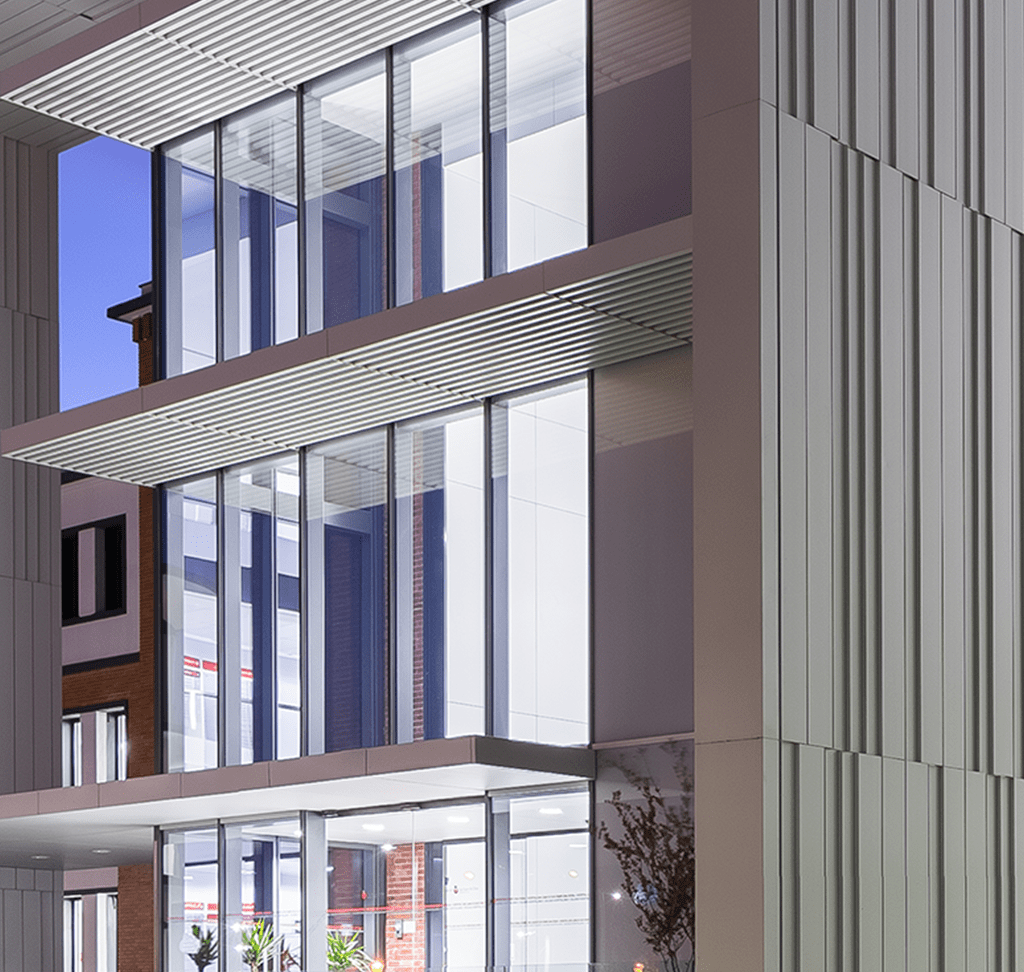

New Supply

Kilroy Realty’s two-building One Paseo office project added 288,484 SF of newly completed Class A space to the Carmel Valley submarket. The project had nearly 260,000 SF space preleased and occupied by several tenants (see Net Absorption section) driving the largest chunk of demand countywide. There are currently 11 buildings totaling more than 2.13 million SF under construction countywide. Some of these projects include two being developed by Kilroy Realty: the 165,000 SF 9455 TCD building in UTC preleased to Apple, and the 219,000 SF 2100 Kettner building in Downtown San Diego. BioMed Realty is constructing Apex, a 204,000 SF building in UTC, preleased to Apple. Lincoln Property Company is developing two buildings in the Aperture Del Mar project in Carmel Valley, totaling 217,235 SF. Stockdale Capital Partners broke ground on the 750,000 SF Campus at Horton on the site of the former Horton Plaza mall in Downtown San Diego.

Trends, Forecast & Outlook

Growing demand in the life science sector is driving up demand for more buildings that will accommodate laboratory and R&D space. This has drawn interest for additional inventory being converted from traditional office space as well as a focus on seeking alternate submarkets for new development. Companies such as Alexandria Real Estate Equities have purchased office buildings in Torrey Pines and the neighboring submarkets of Sorrento Mesa and Sorrento Valley for conversion to life science space to meet demand.

Additionally, an opportunity for as much as 1.3 million SF of new life science space to be constructed in Downtown San Diego has become available through an acquisition by IQHQ REIT of the former Manchester Pacific Gateway mixed-use project. The project – The San Diego Research and Development District (RaDD) – has the potential to create for the first-time a brand-new life-science cluster outside of San Diego Golden Triangle and the North City. The new project replaces the previous plans by Manchester Financial Group for over 1.5 million SF of Class A office space. In UTC, Alexandria is partnering with Regency Centers to renovate the Costa Verde Shopping Center into a mixed-use

shopping center with an additional 400,000 SF of tech/R&D space. Construction on this new Costa Verde Life Science Campus is expected to break ground by mid-next year.

The ongoing COVID-19 pandemic has created an immediate effect on demand with potential for future challenges, as many companies considered “non-essential” require their workforces to work from home. Considerations for office users, operators, and owners will not only need to contend with the immediate effects of the COVID-19 aftermath on their businesses, but at long-term effect on office workplace culture, workstyle, and space utilization.

By year-end, it is likely that direct and sublease vacancy will tend to increase steadily as net absorption posts additional negative demand. Asking rental rates may continue to see minimal decreasing but will likely stabilize early next year.

.ashx?bid=2c3f8386cf504a8d8ca5b714081ece58)