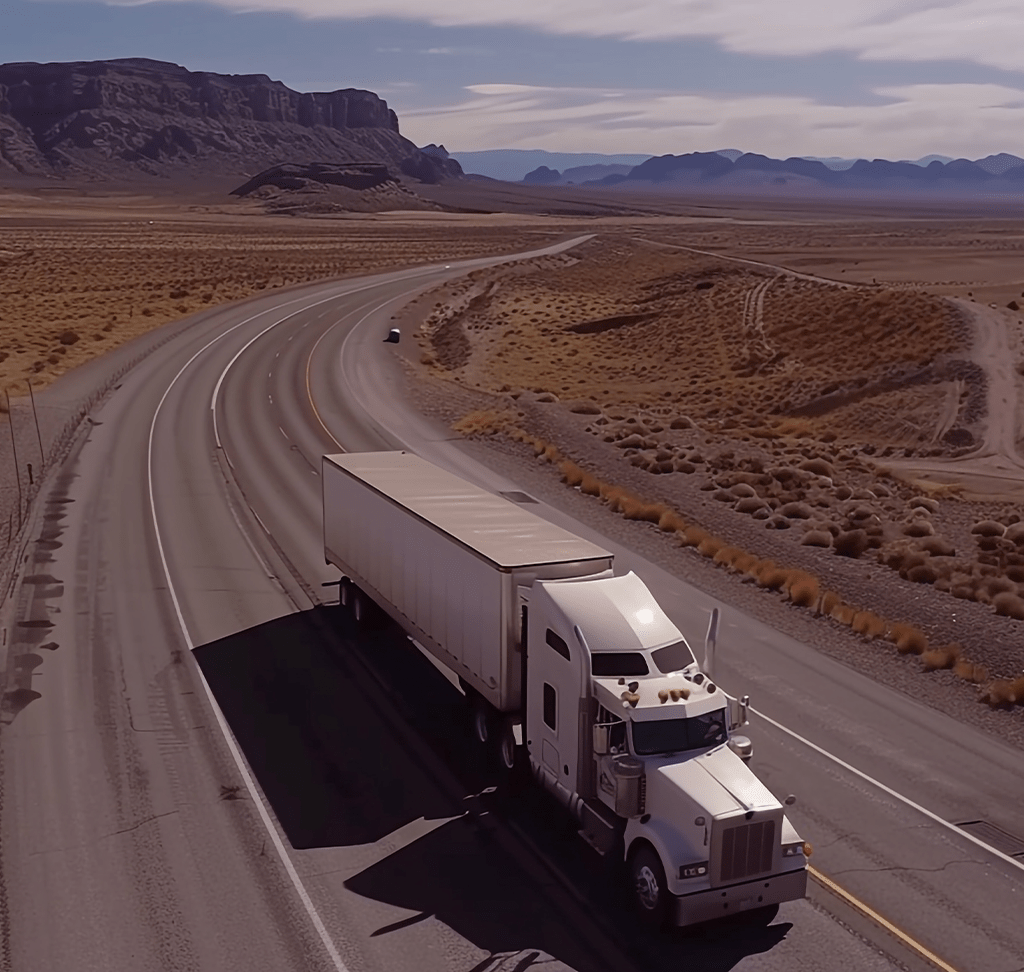

Industrial demand has accelerated under and after

COVID with e-commerce distribution and new supply

chain requirements leading the way.

Patrick Duffy | President

Key Takeaways

- Tour activity increases

- Leasing activity robust

- Absorption remains positive

- Vacancy increases slightly as new product delivers

- Construction activity increases over the quarter, but down on an annual basis

Houston Highlights

Houston’s industrial market continues to see robust leasing activity moving into 2021, recording close to 9 million SF in the first quarter. Houston recorded an average of 8 million SF of leasing activity per quarter in 2020. According to Colliers industrial advisors, tour activity increased over the quarter in both leasing and investment interest. Some of the larger leases signed in Q1 include Awesung (239,124 SF) in the Southwest Corridor, Keller Warehousing & Co-Packing LLC (223,061 SF) in the Northwest Corridor, Amazon (180,000 SF) in the South Corridor, Soft-Tex International, Inc. (166,970 SF) in the Southwest Corridor and Averitt Express, Inc. (159,793 SF) in the Southeast Corridor.

Market Indicators

Historic Comparison

Market Fundamentals

Executive Summary

Commentary by Walker Barnett | Principal & Director

The steady leasing activity of Q1 2021 was a natural follow-up to the reawakening seen in Q3 and Q4 of 2020. The increasing availability of the COVID-19 vaccines in February and March strengthened consumer demand and built market confidence. Owners and asset managers and prospective tenants who had not traveled over the past year came to the market in growing numbers. Investors continued to pursue income-producing and value-add opportunities with declining yields. Industrial assets that had previously seen 1-2 tours per month saw 3-5 tours per week. As predicted, the uniquity of the vaccine spurred new tenant and buyer demand across all sectors of the industrial market.

As the economic activity increases, the market has also experienced the consequences of the deficiencies in the global supply chain. Some transactions around furniture, automobiles and other consumer goods were delayed due to manufacturing delays and shipping problems. According to Lloyds, a single container ship blocking the Suez Canal for six days caused a global trade disruption of an estimated $9.6 billion each day. Major U.S. auto manufacturers had to idle more than one dozen plants due to a global shortage of semiconductors. Since August, long steel products have seen price increases of 30-40% based on increasing demand and limited supply. These individual data points in the aggregate indicate how much capacity was removed from the supply chain. It will take months, if not years, for the supply chain to right-size itself.

With these stresses has also come the opportunity that benefits Houston’s industrial market. As a major port city, we continue to see “third-coast” diversification with companies locating distribution centers near the Port Houston. There are several significant transactions over 500,000 SF pending lease execution now that will quickly swing the pendulum from a tenant-favored market to a landlord-favored market. The sharp increase in construction pricing will cause some developers to limit new construction and create economic opportunities for owners who have just delivered buildings or were fortunate to lock down construction pricing before the price increases.

As the U.S. emerges from the COVID-19 fog, the success of the vaccination programs has supplied the proverbial shot in the arm for robust economic growth for years to come. Overall, industrial markets in Houston and Texas will continue to benefit from mounting consumer confidence and resulting economic growth. While COVID laid bare many of our societal wounds, it also showed people that there is a better way; there are cities that reward hard work and offer a level playing field for business owners who want to provide for their families and have a better quality of life. We continue to see companies considering relocation from the challenging labor markets and dysfunctional regulatory environments of the Rust Belt and California. Housing prices continue to increase. Leasing activity continues to improve. The transitional period of Q1 2021 bodes very well for extraordinarily strong absorption and market health for the balance of 2021.

Under Construction

Institutional Inventory - 250,000 SF or Greater

Construction Activity

Houston Industrial Construction

.ashx?bid=2c3f8386cf504a8d8ca5b714081ece58)