Research & Forecast Report

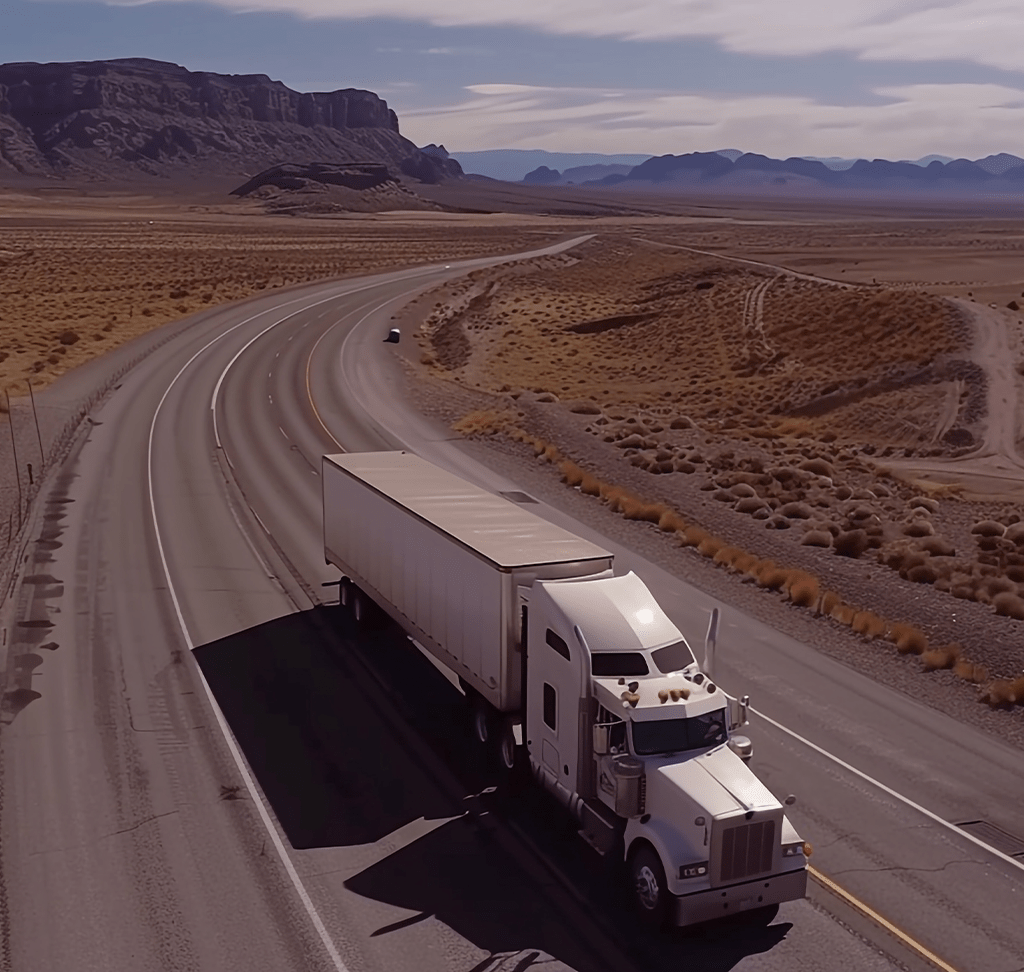

COLUMBUS | INDUSTRIAL

Q4 2020

As we publish this report, the U.S. and the world at large are facing a tremendous challenge, the scale of which is unprecedented in recent history. The spread of the novel coronavirus (COVID-19) is significantly altering day-to-day life, impacting society, the economy and, by extension, commercial real estate. The extent, length and severity of this pandemic is unknown and continues to evolve at a rapid pace. The scale of the impact and its timing varies between locations. To better understand trends and emerging adjustments, please subscribe to Colliers’ COVID-19 Knowledge Leader page for resources and recent updates.

The Columbus industrial market finished 2020 with a strong fourth quarter, posting 2,184,850 square feet of net absorption. This brings year-to-date net absorption to over 10.6 million square feet - the highest annual absorption the Columbus market has ever recorded. The already thriving industrial sector has skyrocketed this year, as the e-commerce industry has grown exponentially due to the ongoing COVID-19 pandemic. Sustained demand in prime warehouse space has yielded absorption greater than 1 million square feet in 13 of the past 14 quarters in Central Ohio. This activity drove vacancy down in the fourth quarter, from 4.9 percent to 4.74 percent. Overall asking rates held steady at $3.89 per square foot, but new speculative availability increased rates for warehouse/distribution properties to $3.74 per square foot. In the past quarter, nearly 2 million square feet of product broke ground and the number of users looking for industrial space increased to 130 tenants, demonstrating the resiliency of the industrial market. Central Ohio can expect continued activity in the new year as COVID-19 fuels demand in the industrial sector.

VACANCY >>

The vacancy rate declined from 4.9 percent to 4.74 percent in the fourth quarter due to positive net absorption. The largest vacancy of the quarter occurred in the Southwest submarket, as Stonecrop Technologies vacated 527,127 square feet of space at 3500 Southwest Drive. The Southeast submarket saw the most significant decrease in vacancy to 5.27 percent, as TJX Companies, KDC/One and Synnex occupied space there.

MARKET ACTIVITY >>

Market activity is often correlated to positive or negative absorption. However, in cases when a tenant leaves one space for another, the positive and negative absorption cancels out. The Market Activity Volume (MAV), which is the absolute sum of absorption change in the market, gives a better idea of overall activity. This quarter, the MAV was 6.9 million square feet – a strong indication that tenants are continuing to stay active in the market.

CONSTRUCTION ACTIVITY >>

Construction activity remains high, as six projects totaling 1.8 million square feet broke ground this quarter. This brings total product under construction to 7,123,430 square feet - the sixth consecutive quarter with over 7 million square feet underway. The Southeast, Madison and Pickaway submarkets lead activity, each with over 1 million square feet of speculative or build-to-suit development under construction. Eight properties totaling 2.5 million square feet reached completion this quarter. The 555,000-square-foot speculative warehouse at 6200 Canal Winchester Blvd. and the 488,000-square-foot FedEx build-to-suit were both finalized. Six additional buildings were also completed, adding prime availability to the market. With 43 projects comprising of over 18 million square feet either planned or underway, Central Ohio can expect more large completions throughout the next year.

SALES ACTIVITY >>

This quarter, 16 industrial properties totaling over 2.5 million square feet sold in Central Ohio for a total sales volume of $194 million. The average price per square foot reached $71, which is $25 higher than the average at the beginning of the year. Monmouth Real Estate purchased 8341 Industrial Pkwy. for $73.3 million, or $150 per square foot - the largest sale of the quarter. Green Door Capital sold 5330 Crosswind Drive to STAG Industrial for $55.55 million in an investment sale. Exeter purchased 870 Claycraft Road from FedOne for $20 million and 2221-2303 John Glenn Ave. from Westmount Realty Capital for $14.2 million.

.ashx?bid=2c3f8386cf504a8d8ca5b714081ece58)