- The Industrial sector is the only sector that saw an increase year-to-date with 9M 2020 investment sales at S$1.87 billion

- Investment sales in Q3 jumped 78% QOQ, albeit still down 64.8% YOY to S$3.99 billion

- Commercial and residential deals made up 87% of the Q3 tally

- Commercial investment sales trebled QOQ to S$2.65 billion, bringing 9M 2020 to S$4.15 billion, down 60% from a bumper 9M 2019

- Residential transactions trebled QOQ to S$844.4 million, as transactions in Good Class Bungalows (GCBs) and landed housing quadrupled

SINGAPORE, 14 Oct 2020 –Colliers International (NASDAQ and TSX: CIGI), a global leader in commercial real estate services, has published its latest market research report which examines the performance of Singapore real estate investment in Q3 2020 and its prospects ahead.

According to Colliers International Research, Singapore investment sales volumes have jumped 78% quarter-on-quarter (QOQ) to hit S$3.99 billion in Q3 2020. They are indeed showing signs of recovery in the second half of the year, with daily COVID-19 cases trending down steadily and the easing of restrictions on workplaces, business travel, religious services and entertainment venues as the economy reopens.

Jerome Wright, Senior Director of Capital Markets at Colliers International, said, “Q3 has seen a rebound, and we can expect volumes to pick up further in Q4 as sentiment improves.”

“With more tech giant setting up bases in Singapore in the last few months and the Urban Redevelopment Authority of Singapore (URA) Incentive Scheme to rejuvenate older precincts, investors will show a bigger appetite for CBD offices building in the long-term.”

Colliers Research reports that despite 9M 2020 commercial volumes falling 60% year-on-year (YOY), Q3 saw a significant jump due to a few notable deals, reflecting investors’ confidence in Singapore real estate.

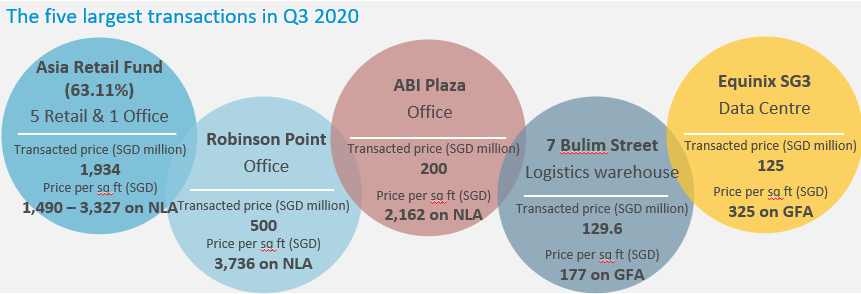

With borders still closed, locally-based investors have been driving investment activities in Q3. Investment sales in commercial and residential sectors rebounded strongly, trebling in volume QOQ. The largest commercial deals during Q3 include Frasers Centrepoint Trust (FCT) acquiring the remaining 63.11% stake in the Asia Retail Fund portfolio of one office and five retail assets for S$1.93 billion; Tuan Sing Holdings selling Robinson Point, a prime freehold office tower located in Shenton Way/ Tanjong Pagar micro-market to One South Bay Group Limited for S$500 million; and MYP selling ABI Plaza, a freehold office also in Tanjong Pagar micro-market to a fund linked to CapitaLand for S$200 million.

Colliers Research Singapore Investment Sales Quarterly Report: Five largest transactions in Q3 (click to enlarge)

Tricia Song (宋明蔚), Head of Research for Singapore at Colliers International, said, “These commercial and residential transactions represent 87% of the Q3 tally. Transactions at below-market cap rates for freehold CBD office assets reflect investors’ long-term focus and their confidence in the Singapore economy.

Commercial

Commercial investment sales trebled QOQ to S$2.65 billion, bringing 9M 2020 to SS$4.15 billion – down 60% from a bumper 9M 2019 which included Duo and 71 Robinson in Q3 2019.

Mr Wright added, “Supported by the low-interest rate environment, investors are hunting for investment opportunities given their substantial pools of capital. Singapore real estate stands out for its stability and growth prospects, over the medium to long term.”

Residential

Residential transactions trebled QOQ to S$844.4 million, as transactions in Good Class Bungalows (GCBs) and landed housing quadrupled. However, total sales were still 72.5% lower YOY on the absence of government land sales and fewer luxury condominiums.

Steven Tan, Senior Director of Investment Services at Colliers International, said “Active transactions in the domestic Good Class Bungalows and foreigner-allowed Sentosa Cove suggest Singapore is a safe haven to High Net Worth Individuals. Monthly developer sales have also been buoyant after the circuit breaker.”

“If this buying pattern continues into Q1 2021, demand for collective residential sales – or en bloc – could pick up by the end of 2021.”

Industrial

Industrial investment sales rose 28.3% QOQ to S$313.1 million on logistics warehouse and data centre transactions. Three large transactions recorded are AIMS APAC REIT acquiring a warehouse at 7 Bulim Street for S$129.6 million, Equinix acquiring the SG3 data centre at 26A Ayer Raja Crescent for S$125 million and a long-held freehold light industrial building in the city fringe – Thye Hong Centre – was also sold for S$112.5 million.

Mr Tan added, “This brings 9M 2020 industrial investment sales to grow 4.8% YOY to S$1.87 billion – the only sector to have seen an increase year-to-date, reflecting investors’ shift in preference for the sector during the pandemic.”

“We expect increased investments in warehouses, and hi-specs spaces, including data centres as e-commerce and technology growth accelerates.”

Download our quarterly investment sales report for Q3 2020 here.