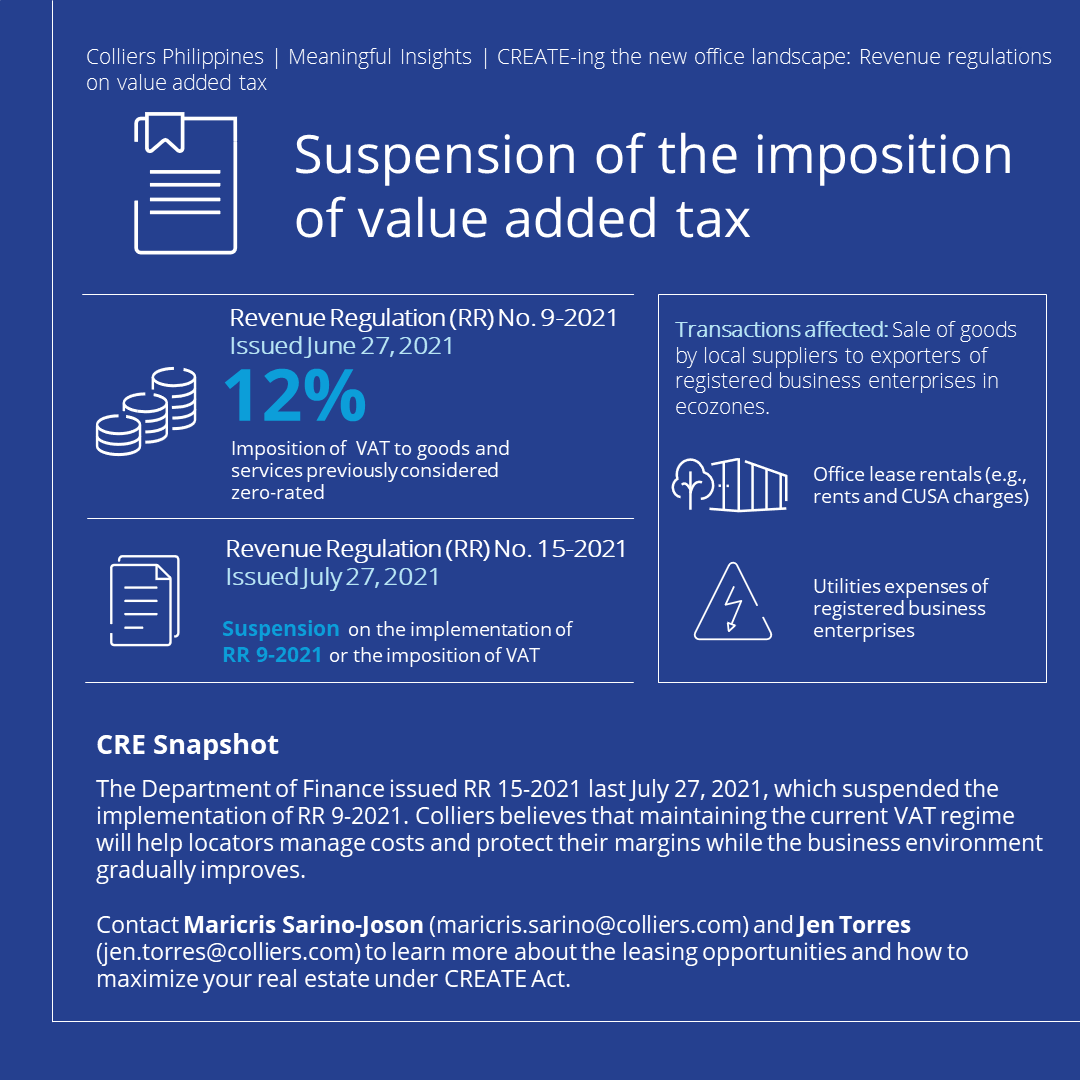

The Bureau of Internal Revenue issued Revenue Regulation (RR) No. 9-2021 last June 11, 2021, in line with the provisions of Republic Act No. 10963 or the Tax Reform and Acceleration and Inclusion Act (TRAIN), which provide that certain transactions previously considered zero-rated shall now be subject to 12% VAT upon (1) the successful implementation of an enhanced VAT refund system, and (2) the payment of all pending VAT refund claims as of December 31, 2017, by December 31, 2019.1

RR 9-2021 was effective beginning June 27, 2021, and under this regulation, the sale of goods by local suppliers to exporters (e.g., office lease rentals and utilities expenses of registered business enterprises in ecozones) would now be subject to 12% VAT.

Several industry associations such as the IT & Business Process Association of the Philippines and agencies such as the Philippine Economic Zone Authority expressed concerns that the immediate imposition of the 12% VAT would risk making the country less competitive and attractive to investors at a time where the economy and many businesses are still recovering. In support of the export industry amidst the continuing COVID-19 pandemic, the Department of Finance issued RR 15-2021 last July 27, 2021, which suspended the implementation of RR 9-2021 until the issuance of an amendatory revenue regulation.

Colliers Views

Colliers is one with the export industry in welcoming RR 15-2021 as maintaining the current VAT regime will help locators manage costs and protect their margins while the business environment gradually improves. For instance, information technology and business process management (IT-BPM) occupiers enjoying the zero-rated VAT on local purchases will not be required to pass on the tax as an additional cost to their end clients.

The development also helps locators in planning their next business decisions and bodes well in terms of the support that locators can look forward to from the government in keeping the Philippines as an attractive investment destination.

Colliers shall continue to monitor the relevant policies such as potential amendatory revenue regulations as the country continues to adapt to the changes brought by the CREATE Act.

For more information on the implications of the CREATE Act on the office real estate market, please feel free to reach out to Colliers’ Tenant Representation team.

Source:

1Maroto, N. G. (2021, June 29). New VAT rules on sale of goods to exporters, PEZA, other ecozones. Grant Thornton Philippines. https://www.grantthornton.com.ph/insights/articles-and-updates1/lets-talk-tax/new-vat-rules-on-sale-of-goods-to-exporters-peza-other-ecozones/ (last accessed: August 4, 2021).