March 2021

During 2019/20 we witnessed what appeared to be a reset in the market after a previous stand-off between differing expectations of vendors and the few purchasers that were active in the market. Vendors seemed willing to accept that they may have to reduce their expectations in order to achieve a sale. As a result, the farms transacting during this period did so at a value some 10 to 20 per cent lower than what we would have expected two years ago.

For more historical information, check out our 2020 Southland sales maps and commentaries: January 2020, May 2020, August 2020.

More recently sentiment appears to have shifted on the back of an imbalance to supply and demand; fewer farms are on the market (66 in March 2017, 29 in March 2021), and improved profitability is creating renewed demand.

Further to the sales on the attached map we understand there are a number of dairy farm sales in the final stages of negotiation.

Market participants

The buyer profile in Southland largely remains local farming entities looking to upscale, add to their portfolios or position themselves for succession, although corporate farming groups still have some presence in the market. There has also been an increase in the number of Equity Partnerships being formed with silent investors looking to own a stake of the business.

In the current environment where the returns are high and the forecast for next year are also above the average for the last few years, there is less inclination to sell. Low bank deposit rates are also a contributing factor as the return on investment they offer is not competitive to the current operational returns.

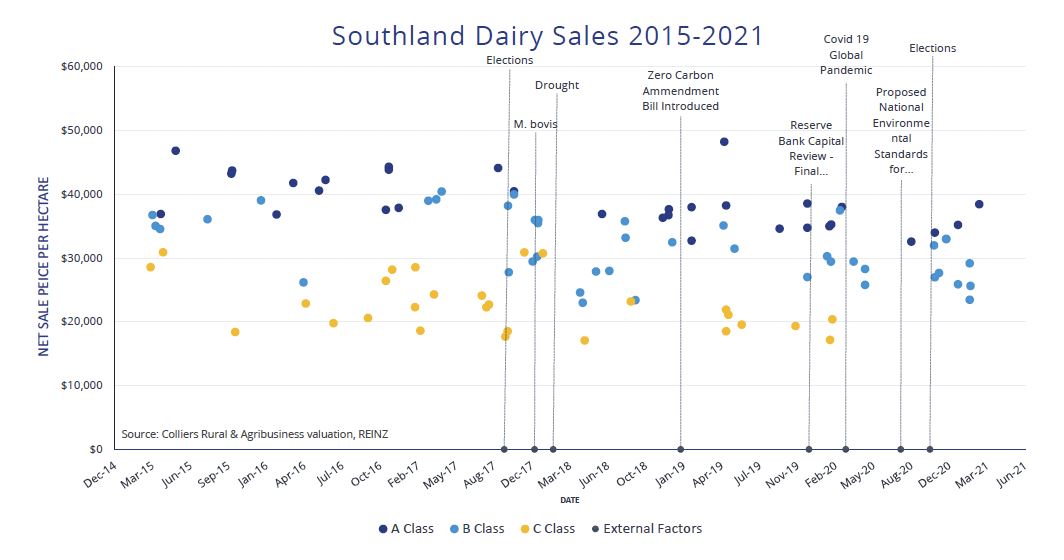

The graph below identifies the net sale price per hectare of A, B and C class properties in the region since the beginning of 2015 together with key external influences. ‘A class’ farms represented in the graph below in blue, are typically situated in the Central Southland locality or the area to the east of Invercargill, on flat land with good soils and have a good standard of buildings, farm infrastructure and improvements:

Environmental standards

Environmental compliance is creating greater complexity in dairy farm businesses, and more uncertainty around the economic viability of dairy farming.

Policy such as the Resource Management (National Environmental Standards for Freshwater) Regulations 2020, National Environmental Standards for Freshwater 2020, and Climate Change Response (Zero Carbon) Amendment Act 2019 will, to some degree, have an impact on management, production and profitability of dairy farming in New Zealand. The Climate Change Commission draft report, open now for public consultation (submissions close 28 March 2021), appears well considered from an environmental standpoint, however; could have even more implications for dairy farm businesses.

Dairy farm negotiations have in some instances required more time to allow for due diligence relating to environmental uncertainty. There have also been some transactions which have fallen through.

Click here to access all our research on the dairy property market in New Zealand, and see the most recent dairy sales maps for Canterbury and Southland.

Follow the links to reach our updates and sales maps on sheep & beef, viticulture and kiwifruit markets in 2020.