What:

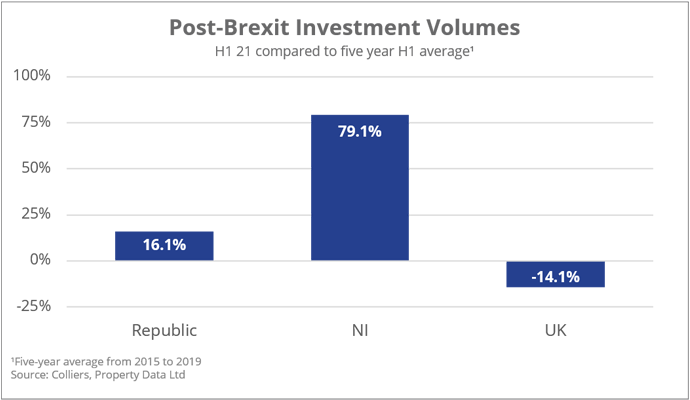

The chart shows the change in investment transaction volumes for the Republic of Ireland, Northern Ireland and the UK for H1 2021 compared to the five year H 1 average. The Republic was up 16.1%, NI was up 79.1% and UK was down 14.1%. Hence, in Ireland, north and south volumes suggest market strength.

Why:

The Northern Ireland Protocol has been disruptive to business across the British Isles. Nevertheless, the investment transaction volume data suggests that investors have not lost confidence in Northern or Southern Ireland despite the political uncertainty that the Protocol has brought. What will always remain unknown, though, is what would the figures have been if protocol uncertainty did not exist. I suspect there is an 'upside’ that remains unrealised due to the uncertainty. For this, we await resolution to the Protocol issues.